ELMRI July 25 Report

Dear Investor,

I am pleased to announce the release of our July 2025 Monthly Report for our Funds. During the month of July, the ELMRI ANZ Conviction Fund increased by 6.4% and the ELM Responsible Investments Global Fund increased by 1.4%.

Market Update:

Global equity markets extended their gains in July, with the S&P 500 rising 2.2% for its third consecutive monthly increase to reach multiple record highs. Strong earnings particularly in technology and AI, alongside stable U.S. economic data and easing trade tensions drove the rally. The Information Technology sector led, gaining over 5%, with broad revenue growth across semiconductors, software and hardware. Consumer sentiment in the U.S reached a five-month high, which was supported by easing inflation expectations and resilient corporate fundamentals despite geopolitical risks.

In Australia, the S&P/ASX 300 rose 2.4%, which was led by the resources sector amid climbing commodity prices. Consumer sentiment improved slightly, supported by expectations of lower future rates despite the RBA maintaining the cash rate at 3.85%. Bond yields moved higher as risk appetite improved, with short-term U.S. yields rising amid tempered rate cut expectations. The RBA’s hold also contributed to a modest increase in Australian yields.

Market Outlook:

The current macroeconomic backdrop is increasingly favourable for our investment strategy. Inflation continues its downward trajectory across major economies, supporting the prospect of central bank rate cuts or easing monetary policy in the near term. Lower rates reduce the cost of capital, which in turn tends to support equity valuations and increase demand for growth-oriented assets.

While pockets of sluggish global growth and patchy consumer sentiment persist, these headwinds are partly offset by easing inflation and stronger corporate earnings, especially in innovation-driven sectors like technology and AI. We remain confident that companies leading in these transformative themes will continue to capture market share and deliver growth, thereby underpinning our positive view on risk assets for the remainder of 2025.

AI Sector Outlook

Artificial intelligence is rapidly reshaping the global economy, driving innovation and efficiency across diverse industries. As AI technologies mature and become more deeply integrated into everyday business operations, the potential for transformative change and substantial investment returns has never been greater.

Our portfolio is strategically positioned to capture this next wave of innovation, focused on an AI ecosystem that stretches from the chips powering AI models to the cloud infrastructure enabling them, and ultimately, to the software applications driving real-world impact.

At the heart of AI development lies the importance of graphics processing units (GPUs), which drive the intelligent tools and services that are rapidly becoming essential to how businesses operate, compete and grow.

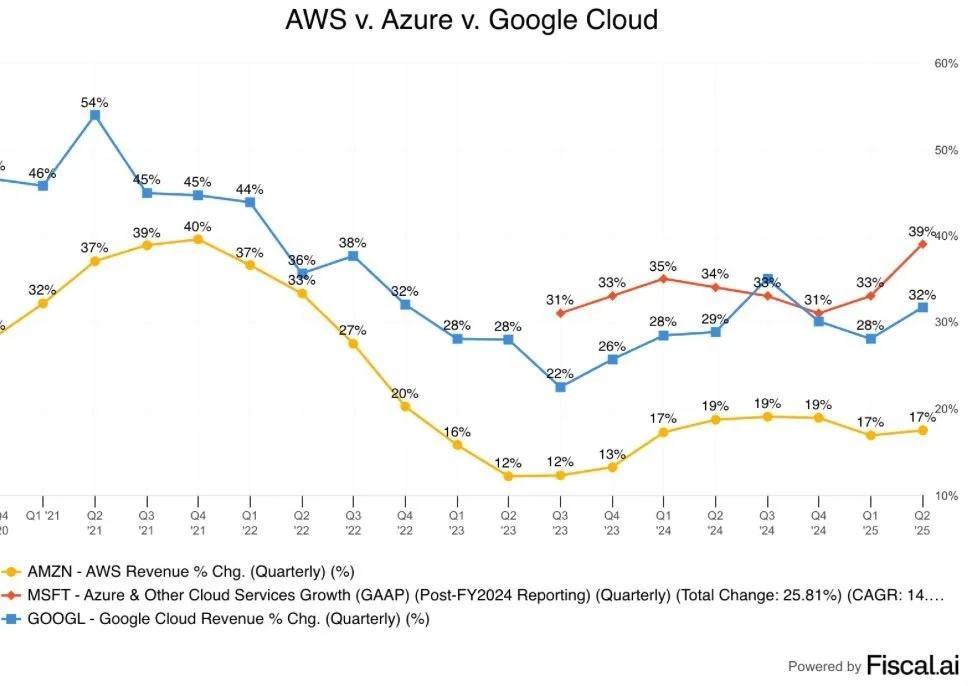

The chart above shows the major cloud providers’ market shares alongside their share of NVIDIA GPU purchases. Microsoft Azure is investing in NVIDIA GPUs at a rate well above its current cloud market share, while Amazon is investing below its share. We believe the speed and scale of GPU investments by cloud providers are key indicators of future AI leadership.

The chart above shows Microsoft Azure’s strong growth in recent quarters, supported by its significant investment in NVIDIA GPUs. This suggests customers are increasingly turning to Azure as their preferred AI cloud provider.

In contrast, Amazon AWS’s slower investment in NVIDIA GPUs has coincided with a period of comparatively weaker growth, allowing Azure to gain market share. While AWS and Google Cloud remain large players, Azure’s aggressive NVIDIA GPU investments may already be translating into faster growth and an early advantage in AI deployment.

While AWS remains dominant, its more cautious approach to GPU acquisition could limit its capacity to handle the explosive demand for AI services in the near future.

Our investment approach captures the AI ecosystem end-to-end. We hold positions across the AI value chain, from semiconductor innovators like NVIDIA, to data center operators scaling infrastructure like Microsoft, and software companies embedding AI into business workflows. As AI evolves, we foresee a pivotal shift from foundational infrastructure build-out to widespread monetisation through practical applications.

This earnings season is positioned to be one of the first to reveal early AI adoption impacts, particularly through operating leverage. Companies integrating AI into customer service, product development and core operations are expected to demonstrate initial signs of cost efficiencies and potentially accelerated revenue growth.

Sustainability Theme Outlook

Renewable energy stocks rebounded strongly in July, reflecting renewed investor confidence amid the global focus on climate action and energy transition efforts. For companies like Vestas, a leader in wind turbine manufacturing, this has translated into tangible market gains. Recent positive developments in U.S. legislation are expected to accelerate onshore wind project approvals, providing significant relief for the sector.

Environmental solutions companies also saw momentum. Ecolab, which provides water, hygiene, and infection prevention solutions across industries, reported stronger-than-expected quarterly results, supported by solid demand in industrial and institutional markets and continued efficiency improvements.

This combination of favourable policy shifts, strong fundamentals around decarbonisation commitments and sustained demand for clean energy and environmental solutions reinforces our positive outlook on sustainability investments.

We view the sector not just as a beneficiary of the energy transition and broader environmental imperatives to drive outsized returns, and one that remains central to our portfolio strategy as the world accelerates toward a more sustainable future.

Company Spotlight: Block

Several weeks ago, I highlighted Block as a company with strong short-term upside. You can read the full article along with my justification here.

On Friday, Block reported quarterly results delivering a 14% year‑on‑year increase in gross profit, with adjusted operating margin rising to 22% from 20% in the prior quarter. Full‑year gross profit guidance was upgraded to $10.17B, from $9.96B, reflecting greater confidence in future performance.

Cash App revenue rose 16% on deeper user engagement, while Square’s renewed mid‑market strategy lifted gross payment volume by 17%.

Following the company’s latest quarterly results, I was asked for further commentary on its long‑term growth trajectory.

ELMRI continues to see considerable potential in the company. From a sustainability standpoint, Block’s platforms are closing gaps in financial inclusion for Americans without traditional bank accounts. Over time, we also expect Square and Cash App to form a fully integrated ecosystem, allowing users to bypass the high transaction fees of conventional payment networks such as Visa and Mastercard. From a valuation perspective, AI is not yet reflected in the company’s numbers, and we anticipate its eventual integration will provide meaningful upside in the years ahead.

Company Spotlight: ServiceNow

ServiceNow’s strong Q2 2025 was driven by rising demand for its AI platform, with subscription revenue up 22.5% year-over-year to $3.1 billion as more businesses integrated AI to improve operations. Strategic partnerships, the acquisition of data.world, global expansion and share buybacks further supported growth.

While Q3 could see some headwinds from contract renewal timing and federal budgets, ServiceNow expects about 20% subscription revenue growth for 2025, with operating margins near 30.5% and gross margins around 83.5%, positioning the company well for ongoing digital transformation across industries.

Company Spotlight: Fisher & Paykel Healthcare

Fisher & Paykel Healthcare (FPH) is a global leader in respiratory and acute care, with their products significantly improving the outcomes of 20 million patients annually worldwide.

The company posted strong results for 2025, with revenue rising 16% to NZ$2.02 billion and net profit after tax increasing 43% to NZ$377.2 million, driven by new product launches and greater manufacturing efficiency.

Hospital segment revenue grew 18% while homecare rose 13%. Operating and gross margins improved meaningfully, with gross margin reaching 62.9%. While tariffs and seasonal swings in hospital demand pose ongoing cost challenges, the company expects revenue growth of around 10% in coming years and forecasts FY26 net profit of NZ$390-440 million.

Conclusion

These companies are all actively investing in innovation and expanding into new markets, with a proven track record of success. We are excited about the future of our companies and remain invested for the long term.

Both the ELM Global Fund and the ANZ Conviction Fund are well-positioned to deliver long-term returns while capitalising on the transformative opportunities presented by AI and sustainability. By adhering to a disciplined investment strategy and focusing on companies driving innovation and positive change, ELM Responsible Investments continues to create value for investors while supporting a sustainable future.

If you wish to discuss any aspect of this report in greater detail, please do not hesitate to reach out. I would be more than happy to arrange a meeting at your convenience. Those interested in investing with us can explore our investment portal and review our fund documentation by clicking the "Invest Now" buttons provided below.

Thank you for your ongoing interest and support.

Kind regards,

Jai Mirchandani

Founder, CIO and Portfolio Manager

ELM Responsible Investments

ELM Responsible Investments Global Fund

ELMRI ANZ Conviction Fund

This note has been prepared by ELM Responsible Investments (‘ELMRI’) ABN 70 607 177 711 AFSL 520428, for Australian wholesale clients for the purposes of section 761G of the Corporations Act 2001 (Cth).

The information is not intended for general distribution or publication and must be retained in a confidential manner. Information contained herein consists of confidential proprietary information constituting the sole property of ELMRI and its investment activities; its use is restricted accordingly.

This note is for general informational purposes only and does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of preparation and presenting and all forecasts, assumptions, opinions, data and other information are not warranted as to accuracy or completeness and are subject to change without notice. This is not an offer document and does not constitute an offer or invitation of investment recommendation to distribute or purchase securities, shares, units or other interests to enter into an investment agreement. No person should rely on the content and/or act on the basis of any material contained in this note. Any potential investor should consider their own circumstances and seek professional advice.

ELMRI funds, its directors, employees, representatives and associates may have an interest in the named securities.

Past performance is for illustrative purposes only and is not indicative of future performance.